Open Your Possible with Expert Loan Services

Open Your Possible with Expert Loan Services

Blog Article

Explore Professional Financing Providers for a Smooth Loaning Experience

Professional funding services offer a pathway to browse the intricacies of borrowing with precision and proficiency. From tailored lending services to individualized assistance, the world of expert lending services is a realm worth discovering for those looking for a borrowing trip noted by performance and convenience.

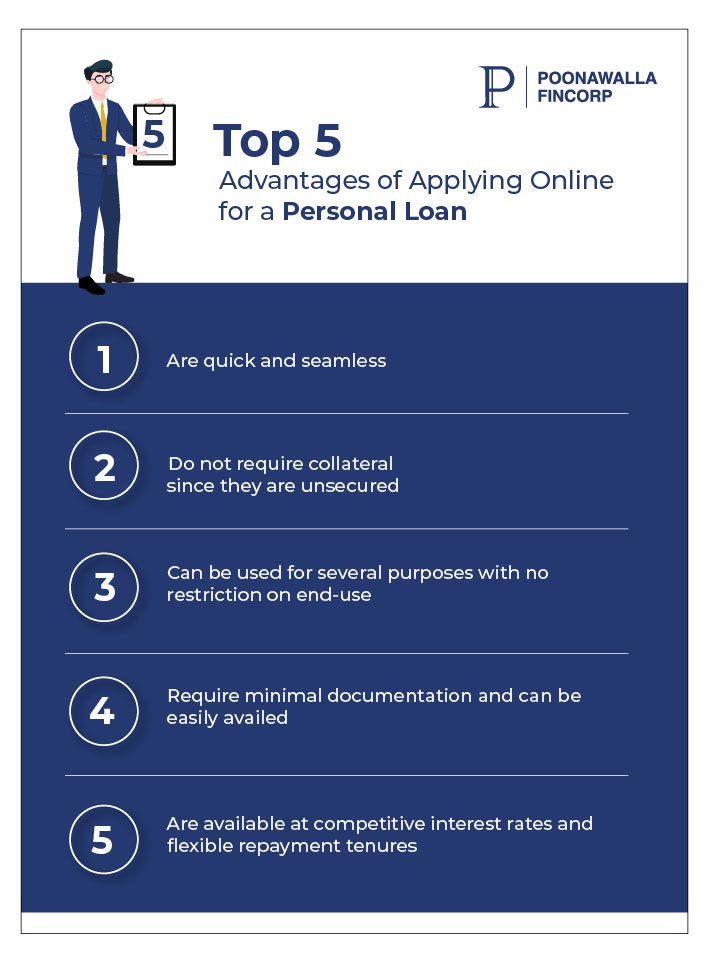

Benefits of Professional Loan Providers

When taking into consideration economic choices, the benefits of making use of expert lending solutions end up being apparent for people and businesses alike. Specialist lending solutions supply know-how in navigating the complex landscape of loaning, giving tailored services to meet certain financial needs. One significant advantage is the accessibility to a wide variety of car loan items from different loan providers, allowing customers to pick the most appropriate choice with positive terms and rates. Furthermore, specialist financing services typically have established connections with lenders, which can result in faster authorization procedures and far better arrangement outcomes for borrowers.

Choosing the Right Lending Company

Having identified the benefits of professional loan solutions, the next important step is choosing the ideal finance supplier to satisfy your particular financial demands successfully. best merchant cash advance companies. When selecting a car loan service provider, it is necessary to think about a number of crucial aspects to make sure a smooth borrowing experience

First of all, assess the credibility and integrity of the finance copyright. Study consumer evaluations, ratings, and reviews to gauge the satisfaction degrees of previous debtors. A trustworthy financing copyright will certainly have transparent conditions, outstanding customer support, and a performance history of integrity.

Second of all, compare the rate of interest, fees, and repayment terms supplied by various car loan carriers - best business cash advance loans. Look for a supplier that provides competitive prices and adaptable settlement choices customized to your financial scenario

Additionally, consider the funding application procedure and authorization duration. Choose a service provider that uses a streamlined application process with quick approval times to access funds quickly.

Streamlining the Application Process

To improve efficiency and comfort for applicants, the funding company has executed a structured application process. One key attribute of this streamlined application procedure is the online platform that enables applicants to send their information electronically from the comfort of their own homes or offices.

Comprehending Loan Conditions

With the structured application process in position to streamline and speed up the loaning experience, the following important step for candidates is obtaining an extensive understanding of the loan conditions. Recognizing the terms of a funding is essential to ensure that borrowers understand their responsibilities, legal rights, and the general price of borrowing. Key aspects to take note of include the rate of interest, repayment schedule, any associated fees, penalties for late repayments, and the overall amount repayable. It is necessary for debtors to meticulously assess and understand these terms before accepting the car loan to prevent any type of shocks or misconceptions later on. Additionally, borrowers should ask about any stipulations connected to early repayment, refinancing alternatives, and prospective adjustments in rate of interest prices over time. Clear interaction with the lending institution pertaining to any unpredictabilities or inquiries regarding the conditions is urged to promote a transparent and equally useful borrowing partnership. By being knowledgeable about the car loan conditions, consumers can make sound economic decisions and navigate the loaning procedure with confidence.

Optimizing Car Loan Authorization Opportunities

Protecting authorization for a loan requires a calculated approach and comprehensive preparation on the component of the consumer. To make the most of finance authorization opportunities, individuals ought to start by examining their credit scores records for precision and addressing any inconsistencies. Keeping an excellent more credit history is essential, as it is a considerable factor thought about by lending institutions when examining creditworthiness. Furthermore, minimizing existing debt and avoiding tackling new debt before making an application for a finance can show economic duty and improve the probability of authorization.

Furthermore, preparing an in-depth and reasonable budget that details income, expenditures, and the suggested funding payment strategy can showcase to lenders that the consumer is capable of taking care of the extra monetary commitment (mca lending). Supplying all essential documents without delay and properly, such as evidence of revenue and work background, can enhance the approval process and instill confidence in the lender

Conclusion

In final thought, specialist financing solutions supply numerous advantages such as experienced advice, customized financing alternatives, and boosted approval opportunities. By choosing the right finance provider and understanding the terms, debtors can streamline the application procedure and ensure a smooth loaning experience (Financial Assistant). It is essential to meticulously think about all facets of a car loan prior to devoting to make certain monetary stability and effective payment

Report this page